Non compound interest calculator

In your first quarter you would earn 6250 in interest making your. The procedure to use the compound interest calculator is as follows.

Simple Interest Calculator Audit Interest Paid Or Received

A mortgage payment calculator takes into account factors including home price down payment loan term and loan interest rate in order to determine how much youll pay each.

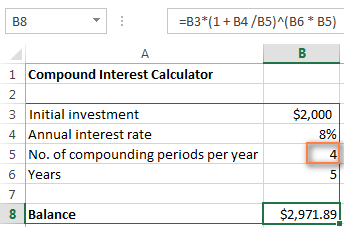

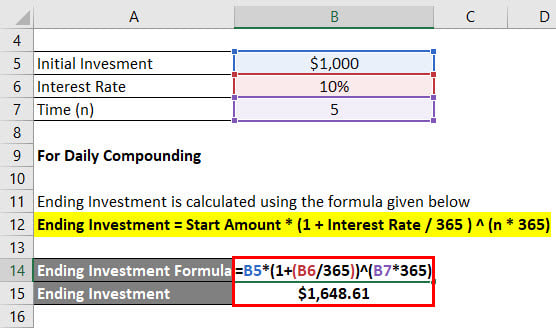

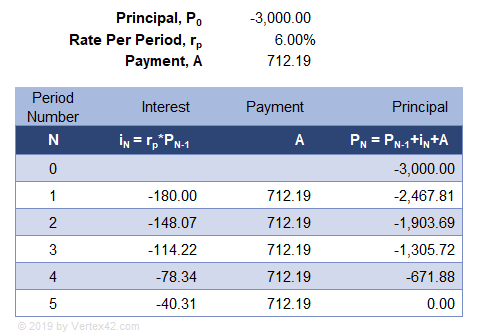

. Compound Interest P 1 i n 1 P is principal I is the interest rate n is the number of compounding periods. Thus the interest of the second year would come out to. Lets say you had 5000 in a money market account with a 5 interest rate that compounded quarterly.

Enter the principal amount interest rate and number of years in the respective input field. The compound interest formula is. Get peace of mind with fixed rates and guaranteed returns.

An investment of 100000 at a 12 rate of return for 5 years. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. Compound Interest Calculator Compound Interest Calculator Compound Interest Formula Compound interest - meaning that the interest you earn each year is added to your principal.

Users should note that the. Compound Interest is calculated on the principal amount and also on the interest of previous periods. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month.

A P 1 rn. A video revising the techniques and strategies for working out compound interest problems without a calculator - Higher and FoundationJoin this channel to ge. Ad Save for college a new home or a dream vacation with guaranteed rates from Capital One.

This calculator allows you to choose the frequency that your CDs interest income is added to your account. 110 10 1. Using this compound interest calculator Try your calculations both with and without a monthly contribution say 50 to 200 depending on what you can afford.

The capital growth rate is a straightforward. The following formula can be used to find out the compound interest. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

The interest on that is now not 200 like in year one but 10200 x 002 204 hence at the end of year two the deposit will be worth 10404. The compound interest of the second year is calculated based on the balance of 110 instead of the principal of 100. The more frequently this occurs the sooner your accumulated interest income will.

Instead borrowers sell bonds at a deep discount to their face value then pay the face value when the bond matures. Build Your Future With a Firm that has 85 Years of Investment Experience. A P 1 rnnt The compound interest formula solves for the future value of your investment A.

Zero-coupon bonds do not pay interest directly.

Compound Interest Formula And Calculator For Excel

Daily Compound Interest Formula Calculator Excel Template

Daily Compound Interest Formula Calculator Excel Template

Interest Formula Calculator Examples With Excel Template

Compound Interest Calculator For Excel

Compound Interest Formula And Calculator Excel Template

Fv Function In Excel To Calculate Future Value

Payback Period Formula And Calculator Excel Template

Effective Annual Rate Formula Calculator Examples Excel Template

Compound Interest Calculator Credit Karma

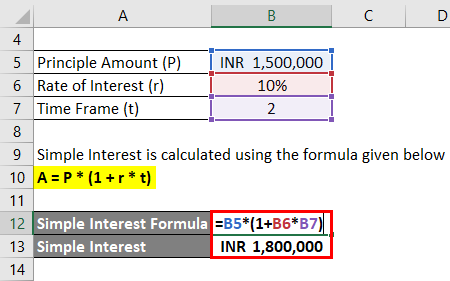

Simple Interest Formula Calculator Excel Template

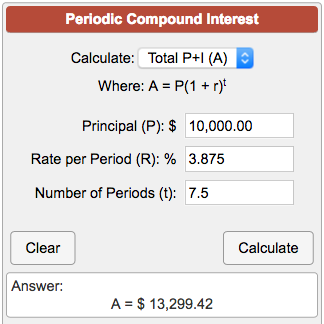

Periodic Compound Interest Calculator

Simple Interest Formula Calculator Excel Template

Compound Interest Calculator For Excel

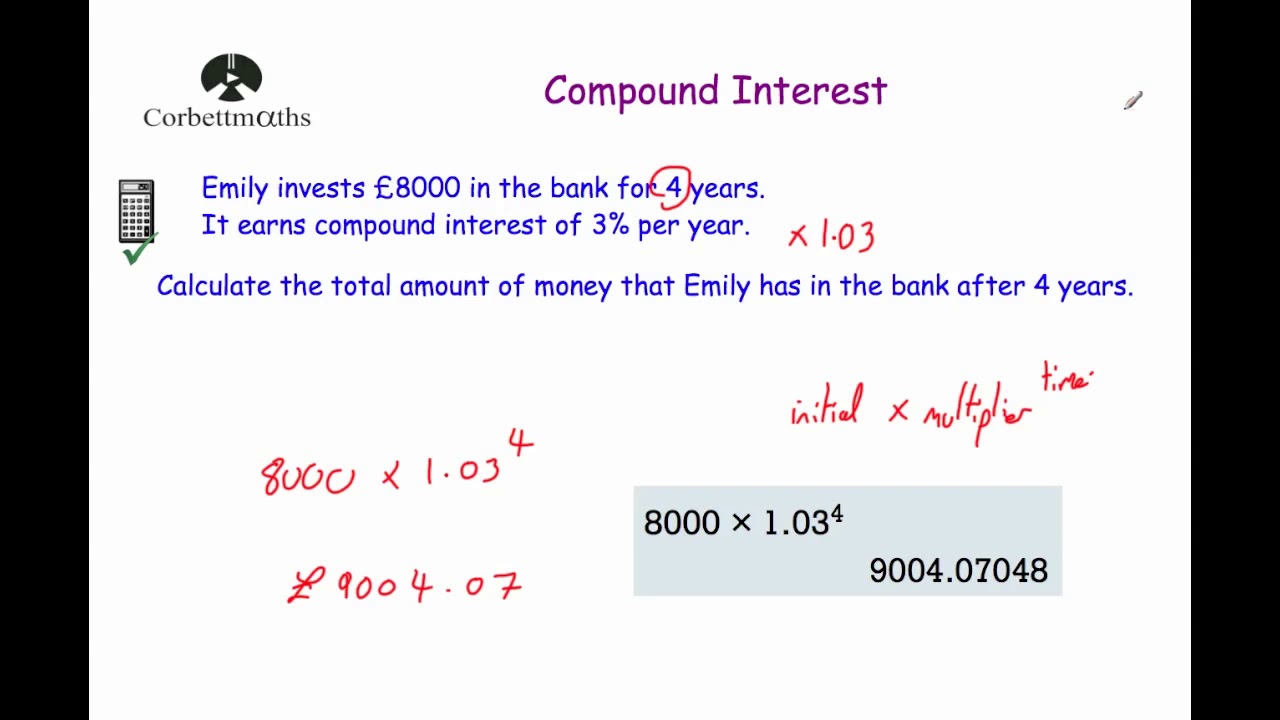

Compound Interest Corbettmaths Youtube

A Visual Guide To Simple Compound And Continuous Interest Rates Betterexplained

Compound Interest Formula And Calculator For Excel